News

We'll get back to you as soon as possible.

Key facts and figures in the Biomethane industry

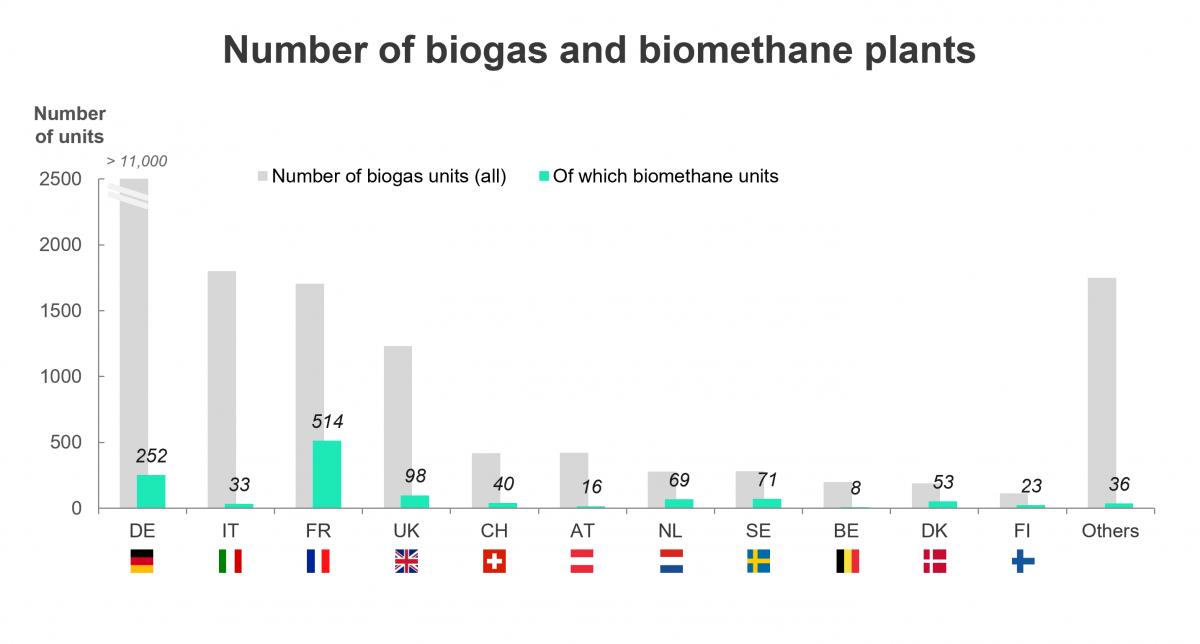

1.By the end of 2022, over 1,200 biomethane plants were officially registered in the main European biomethane-producing countries, contributing 37 TWh of biomethane to the grid.

2.Agricultural residues including manure, crop residues and intermediate crops, amount to 43% of the feedstocks used compared to 39% in 2021, reflecting a shift towards more sustainable feedstocks.

3.Biogas upgrading is experiencing a surge, with biogas upgrading capacity increasing by 30% in three years with a significant contribution from dynamic countries such as France.

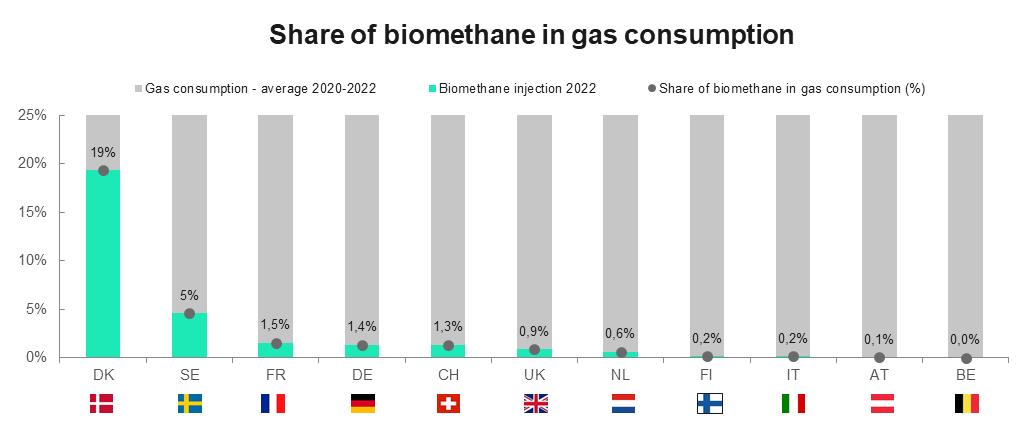

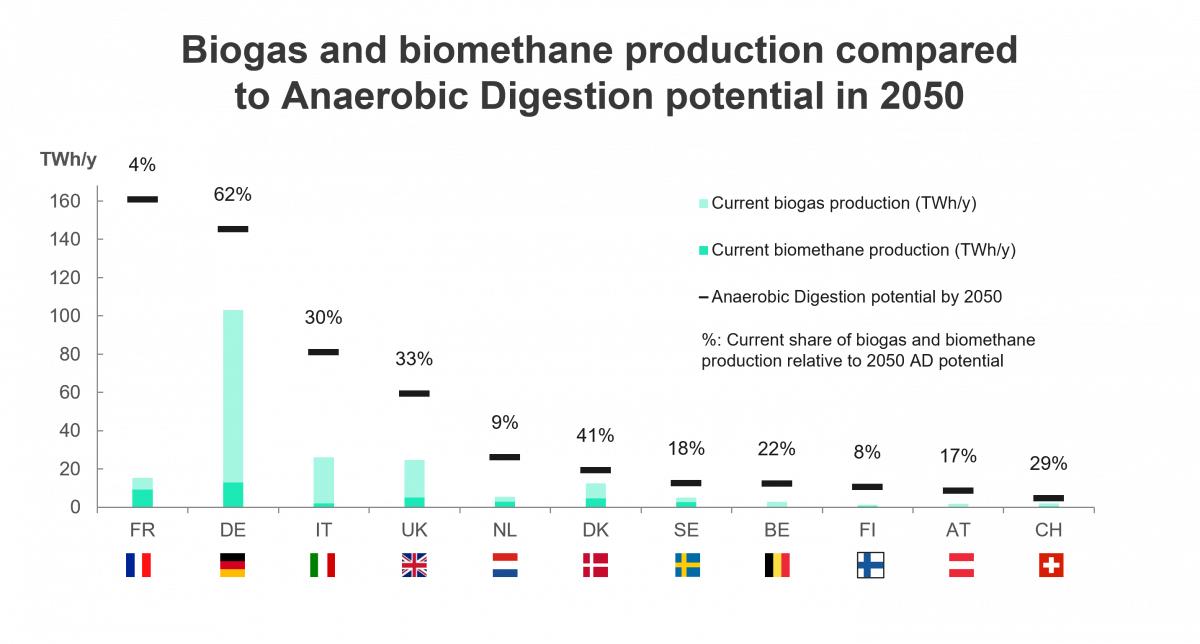

4.Biomethane makes up less than 1% of Europe's gas consumption, while Europe is currently using 4% of its anaerobic digestion potential, suggesting that the sector still holds huge potential to reach the 2030 target of 35 bcm.

5.To reduce reliance on government funding, countries are increasingly adopting instruments such as tendering systems and quotas as the preferred mechanisms to enhance the integration of biomethane into the gas and fuel mix.

An overview of the biomethane sector in 2022

There has been a 17% increase in registered plants in 2022 compared to 2021. Of the existing 1,200 biomethane plants, 90% are already connected to the grid, contributing 37 TWh of biomethane injected into the grid.

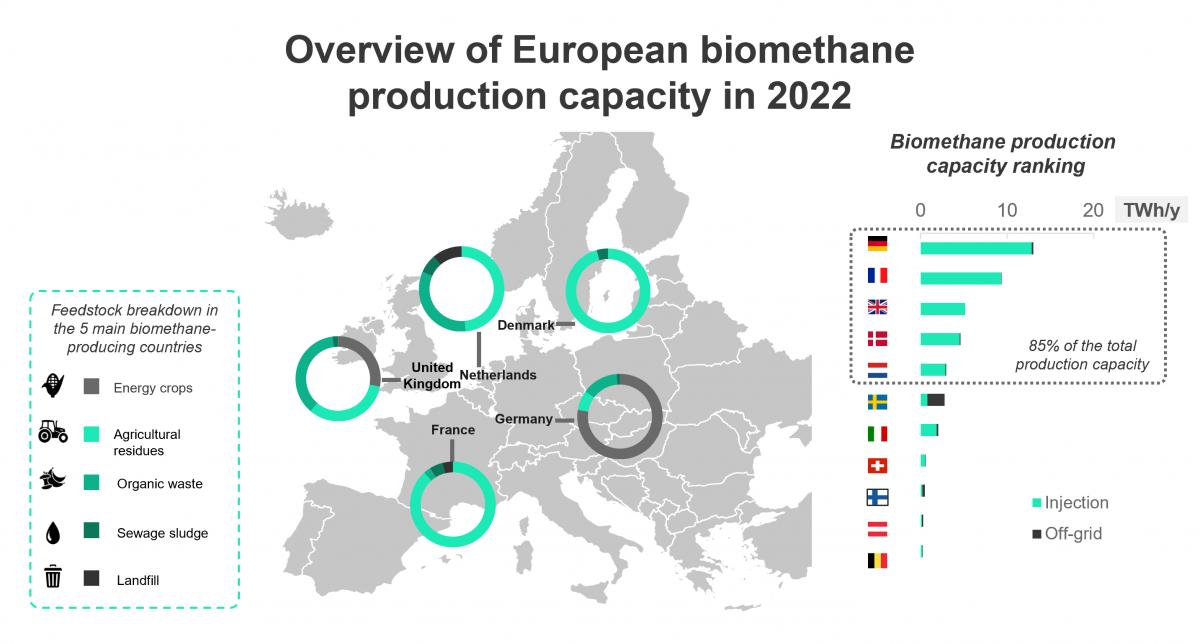

Biomethane plants currently represent a total raw biogas upgrading capacity of 0.9 million cubic meters per hour and a biomethane production capacity of 44 TWh in 2022, which is equivalent to 4.2 bcm. By reaching this milestone, European biomethane producers have now reached 12% of the 2030 target of 35 bcm.

However, there is a clear potential to expand biomethane production, as only 6% of biogas plants in Europe are registered as biogas upgrading units.

An increasingly sustainable input mix

Agricultural residues including manure, crop residues and intermediate crops, amount to 43% of the feedstocks used compared to 39% in 2021, reflecting a shift towards more sustainable feedstocks.

The majority of existing biogas plants are supplied by agricultural residues, energy crops and organic waste. Agricultural residues account for 43% of the total feedstocks used in Europe, mainly in France. Since 2019, the use of agricultural residues as a feedstock has increased by 70%, representing a promising way to reduce methane emissions from agriculture which is causing more than half of European methane emissions.

Energy crops account for more than 27% of the total feedstocks and are particularly popular in Germany and the UK. However, their uses have been gradually declining, as no new plants have been established since 2019.

Organic waste which is derived from both municipal and industrial sources is increasingly used as feedstock and now makes up 21% of the total mix. By extracting value from waste, biogas and biomethane play a vital role in contributing to the circular economy.

Since its introduction in 2017, landfill gas usage has more than quadrupled, yet it accounts for only 2% of the total mix.

Over the past few years, the biomethane sector has experienced steady growth in Europe. Biogas upgrading capacity increased by more than 30% in 3 years, growing from 0.7 million cubic meters per hour (3.2 bcm) in 2019 to 0.9 million cubic meters per hour (4.2 bcm) in 2022.

This phenomenon mainly results from strong growth in several leading countries, particularly in France where 149 new biomethane units have been commissioned in a single year (+41%). Smaller players like the Netherlands, Finland, Italy, and Belgium are following suit. Meanwhile, established countries like Germany, which still has the highest number of biogas units and biomethane production capacity in Europe, Austria, Denmark, and Sweden remained stable over the past few years.

Biomethane makes up less than 1% of Europe's gas consumption, while Europe is currently using 4% of its anaerobic digestion potential, suggesting that the sector still holds huge potential to reach the 2030 target of 35 bcm.

Countries display distinct levels of anaerobic digestion deposits and diverse levels of utilization. Presently, 4 bcm is produced annually out of a total potential of 90 bcm that can be achieved through anaerobic digestion using readily available feedstocks. In total, this accounts for 4% of the overall deposit and less than 1% of the gas consumption. However, the untapped potential in Europe is substantial with 161 bcm when including gasification. This surpasses the targeted 35 bcm by more than four times.

To reduce reliance on government funding, countries are increasingly adopting instruments such as tendering systems and quotas as the preferred mechanisms to enhance the integration of biomethane into the gas and fuel mix.

Countries with well-established biomethane industries are shifting from investment subsidies and feed-in tariffs to tendering systems, aiming to encourage the industry to lower its costs and reduce dependence on suppor